Thursday, November 13, 2014

by The Hat Team

I am often asked, “Should sellers fix up their home before selling?” First, let’s talk about the stuff any Realtor is going to tell you so you have context for the rest.

It is easier to sell a house that is attractive to buyers and shows as being well-maintained. That is a matter of doing  a little fix-up, but mostly clean-up. Make sure pipes aren’t leaking, for instance. That is relatively easy and not expensive. If your home really needs painting consider doing that. These are not high priced issues. Below we are talking about the expensive items.

a little fix-up, but mostly clean-up. Make sure pipes aren’t leaking, for instance. That is relatively easy and not expensive. If your home really needs painting consider doing that. These are not high priced issues. Below we are talking about the expensive items.

If your house has structural defects or other problems that are expensive to fix you have more challenging decisions to make. First, remember that every house has defects! That is simply the nature of a complex structure. Second, savvy buyers know to expect defects so don’t try to hide them. Don’t kid yourself that if a problem can’t be seen easily it won’t be found out.

Most buyers assume there are some problems with any house. If they make an offer that you accept they will pay for a professional home inspector who knows real estate. Good buyer inspectors are very thorough. They are being paid by the buyer and are looking out for the buyer’s interests, not yours. It is not unusual for an inspection report to be in excess of twenty pages…in small type! Being honest with yourself about defects will prepare you better when you are faced with that inspection report.

So, the question becomes “Do I fix the problems before going on the market, or do I make it clear that I am selling “as-is” and discount the price accordingly?” The obvious follow-up question is “If I spend the money before selling, will I get that money back in the final sale price?” The general answer is that it depends on the nature of the defect and magnitude of the likely cost of repair.

Potential buyers are most likely to overestimate the cost if they have to make the repair and under-estimate the cost if the seller is paying. Cost versus value then becomes a negotiation to establishing a final purchase/sale price. If the cost of repair is major, such as a septic system, it makes the most sense to repair it before selling.

The best way to go about making these decisions is to pay a professional home inspector in your real estate market to make an inspection on your behalf as the seller. Their report will give you a thorough list of issues you might be faced with. It will also give you the tool to get estimates from contractors to make the repairs. Then you have a sound basis for making decisions.

An added benefit to having your own inspection on hand is that you have a professional document that you can use when negotiating with a buyer. Be practical and be prepared with your own inspection.

Information courtesy of Montgomery Real Expert Sandra Nickel.

.jpg)

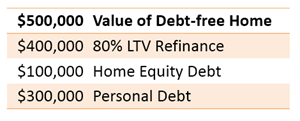

Qualified mortgage interest is deductible on taxpayers' returns subject to the maximum acquisition debt of one million dollars. For the fortunate homeowners who have paid off their mortgage, their acquisition debt was reduced to zero and only the interest on a maximum home equity debt of $100,000 is deductible.

Qualified mortgage interest is deductible on taxpayers' returns subject to the maximum acquisition debt of one million dollars. For the fortunate homeowners who have paid off their mortgage, their acquisition debt was reduced to zero and only the interest on a maximum home equity debt of $100,000 is deductible. before the temperatures get down too low to get your home ready for the cold. In this blog we are going to give you three ways to

before the temperatures get down too low to get your home ready for the cold. In this blog we are going to give you three ways to

a little fix-up, but mostly clean-up. Make sure pipes aren’t leaking, for instance. That is relatively easy and not expensive. If your home really needs painting consider doing that. These are not high priced issues. Below we are talking about the expensive items.

a little fix-up, but mostly clean-up. Make sure pipes aren’t leaking, for instance. That is relatively easy and not expensive. If your home really needs painting consider doing that. These are not high priced issues. Below we are talking about the expensive items.